Our Vision

Our vision was simple yet ambitious: empower analysts to make smarter, faster, and fairer credit decisions through a platform that feels intuitive, flexible, and powerful. We wanted to eliminate the guesswork, the delays, and the disconnected tools that make modern lending inefficient.

We envisioned a world where every analyst could:

Instantly access all relevant applicant data

Build and compare finance structures effortlessly

Collaborate with funding teams

Rely on AI-generated insights without losing transparency

MY ROLE:

User Research & Insights

We kicked off with interviews and workshops involving loan officers, underwriters, and even end borrowers. We asked: What frustrates you about the current process? What data do you need? We discovered that compliance and trust were paramount – users wanted clear explanations of decisions and an interface that felt modern.

Gaps in the Fintech Experience

We conducted an in-depth market study to understand where current Tier-1 credit decision engines like FICO® Origination Manager, Experian PowerCurve, and SAS Decision Manager fell short.

Complex user experience: switching between alot of tabs

No Comparison Between multiple finance structures

Developer dependancy to update rules

No centralised audit log

Unclear finance structure approval

Pending/cleared stipulations tracking

System Switching

Market/Applicant deep insights

Solution Strategy

Our product strategy was shaped by the recurring frustrations and unmet needs we heard from analysts and managers alike. We anchored our solution around three foundational pillars:

A single source of truth that unifies applicant, asset, and deal data in one cohesive dashboard.

Give analysts the power to build, compare, and approve finance structures—without technical support.

Break the silos between credit and funding teams with built-in communication and shared visibility.

Potential Solutions

Our product strategy was shaped by the recurring frustrations and unmet needs we heard from analysts and managers alike. We anchored our solution around three foundational pillars:

Problem

UX Response

Problem

UX Response

User Flows

Our product strategy was shaped by the recurring frustrations and unmet needs we heard from analysts and managers alike. We anchored our solution around three foundational pillars:

Blueprints of the Solution

Before diving into high-fidelity visuals, we focused on translating insights into structure. These low-fidelity wireframes helped us rapidly map out user flows, define key touchpoints, and validate content hierarchy with stakeholders. The goal was clarity—minimizing complexity while ensuring every component had a clear purpose. These wireframes became our blueprint, enabling quick iteration and alignment between design, product, and engineering teams.

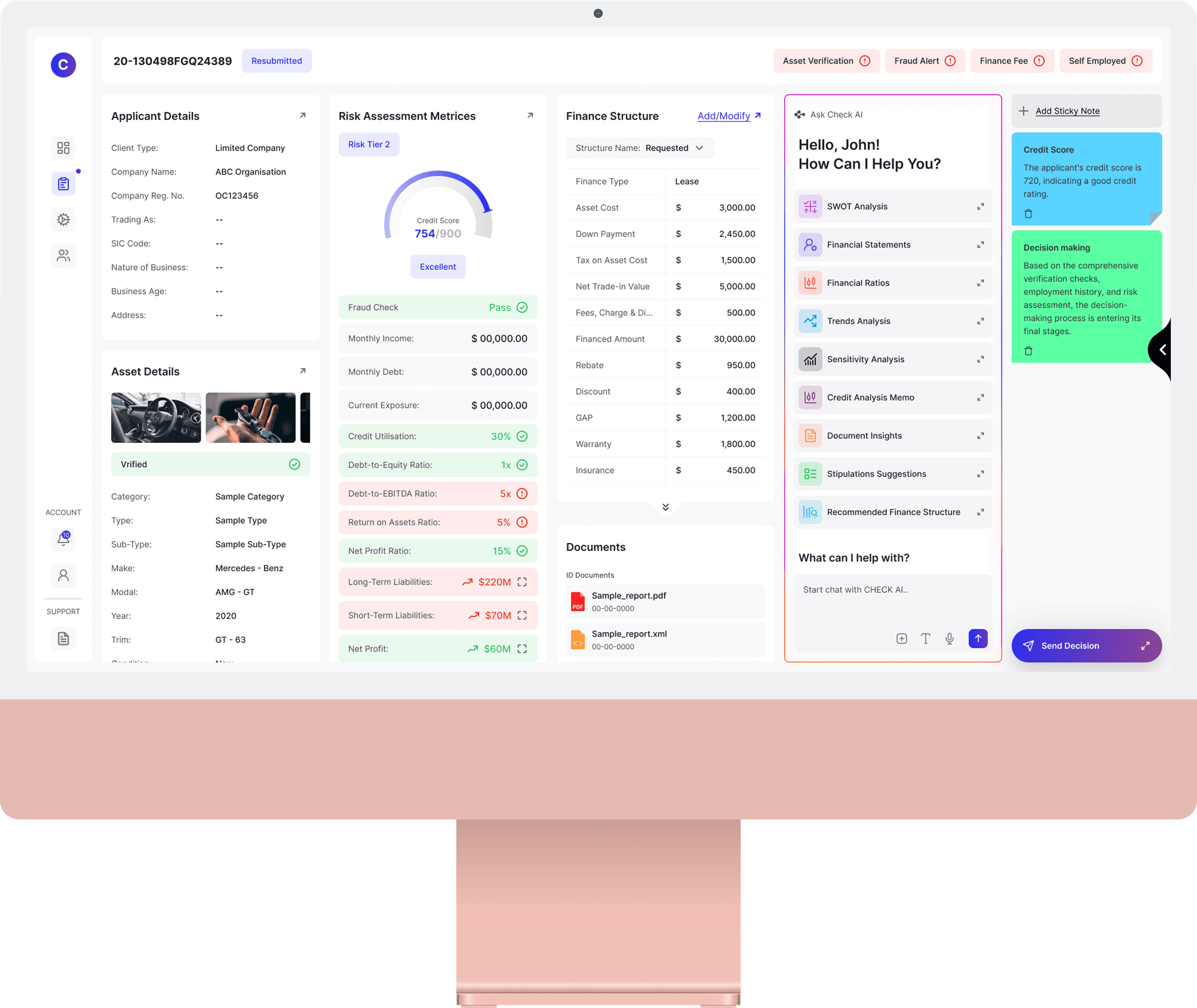

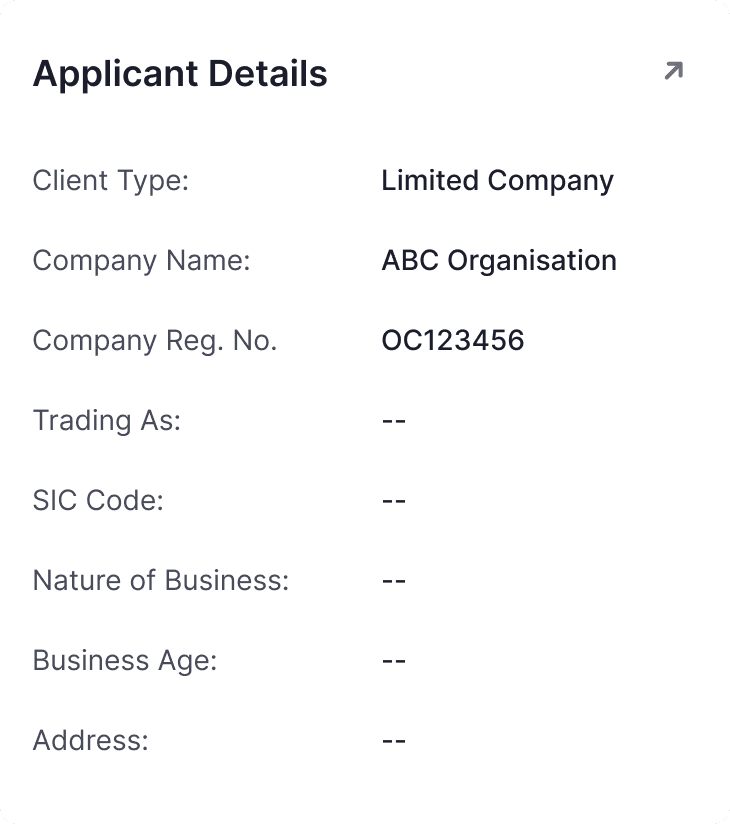

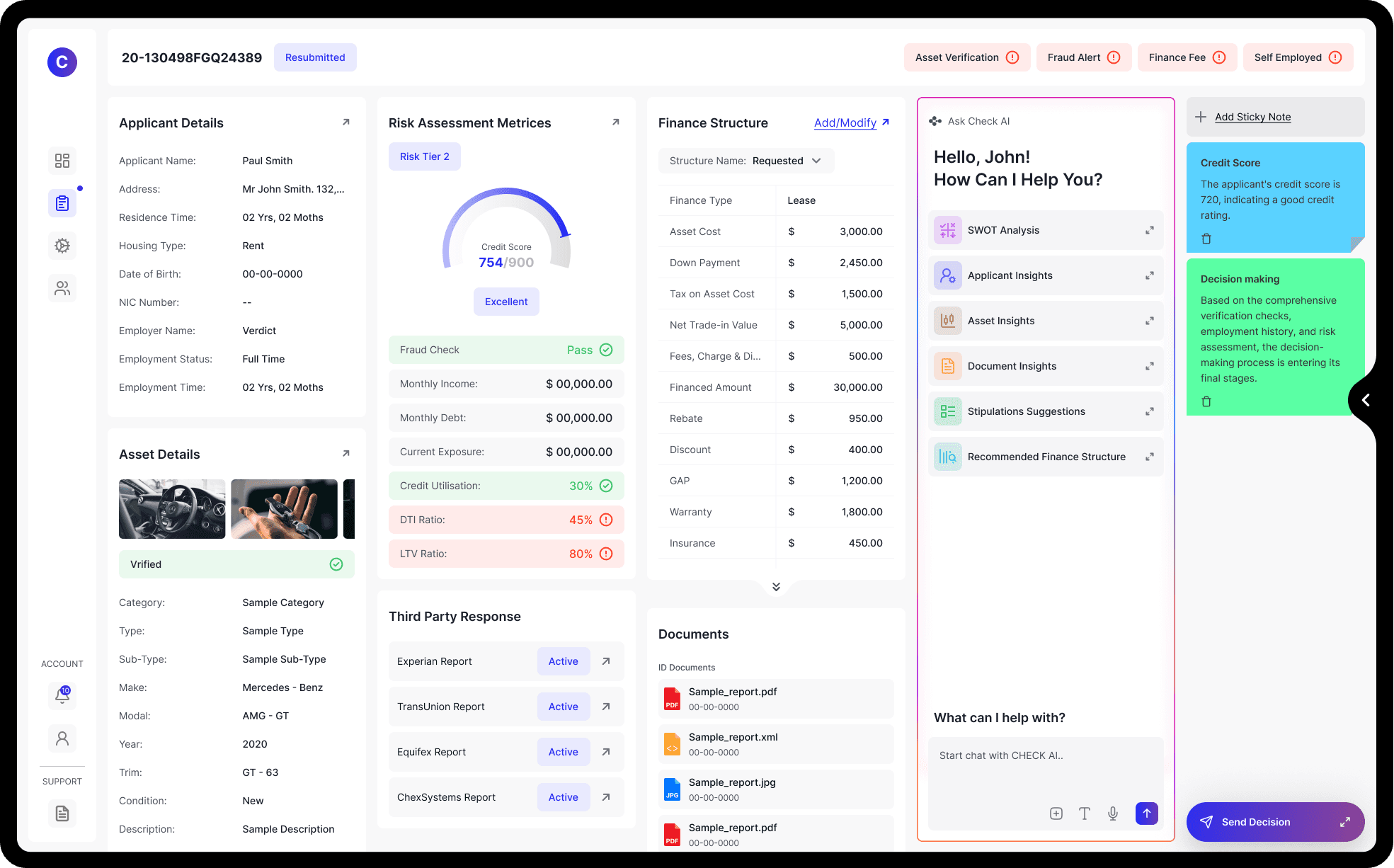

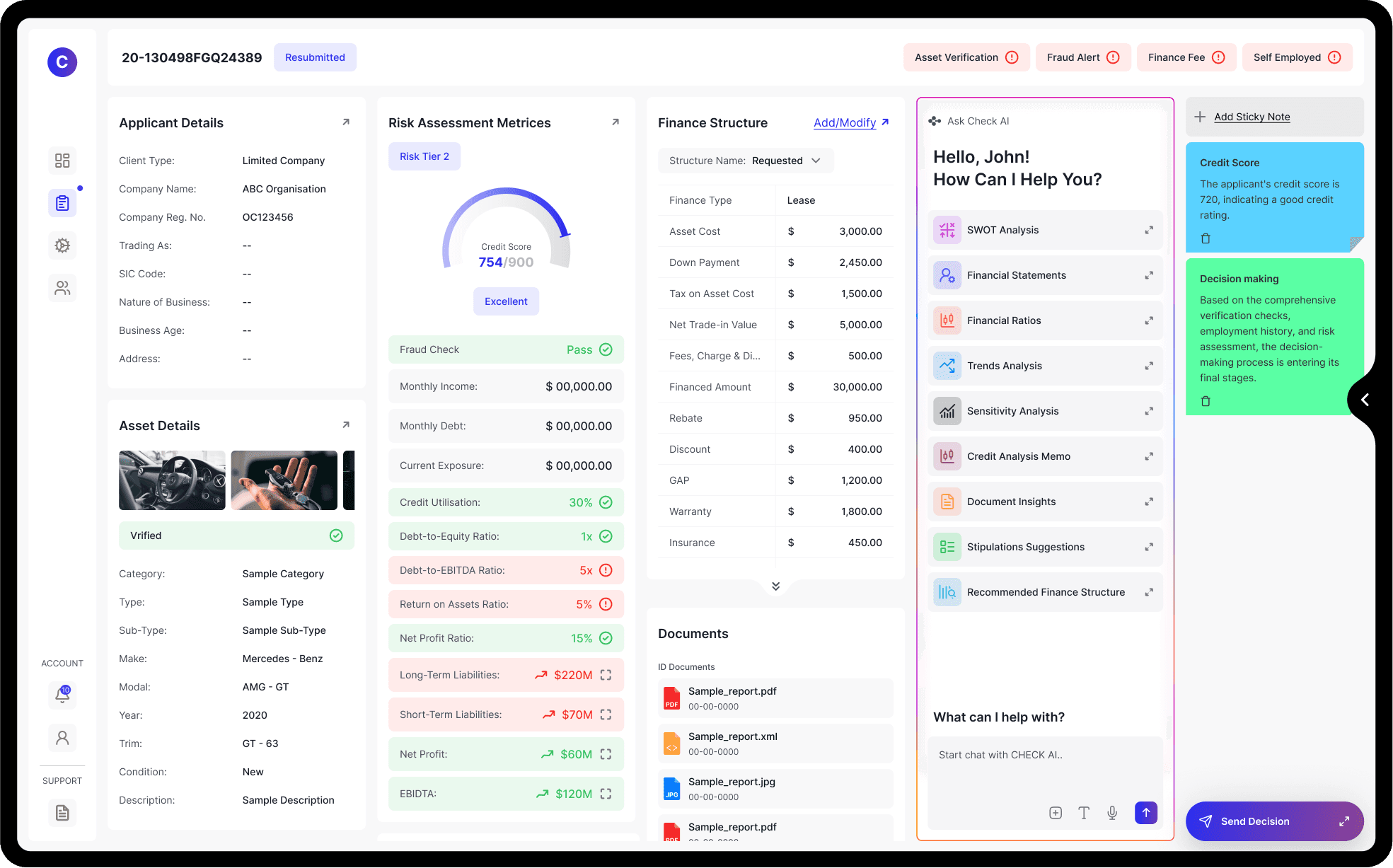

One View to Rule It All: Applicant Dashboard

A unified, 360° view of the applicant—credit profile, income, documents, risk tiers, and history—all in one intelligently organized interface.

Asking with Check AI

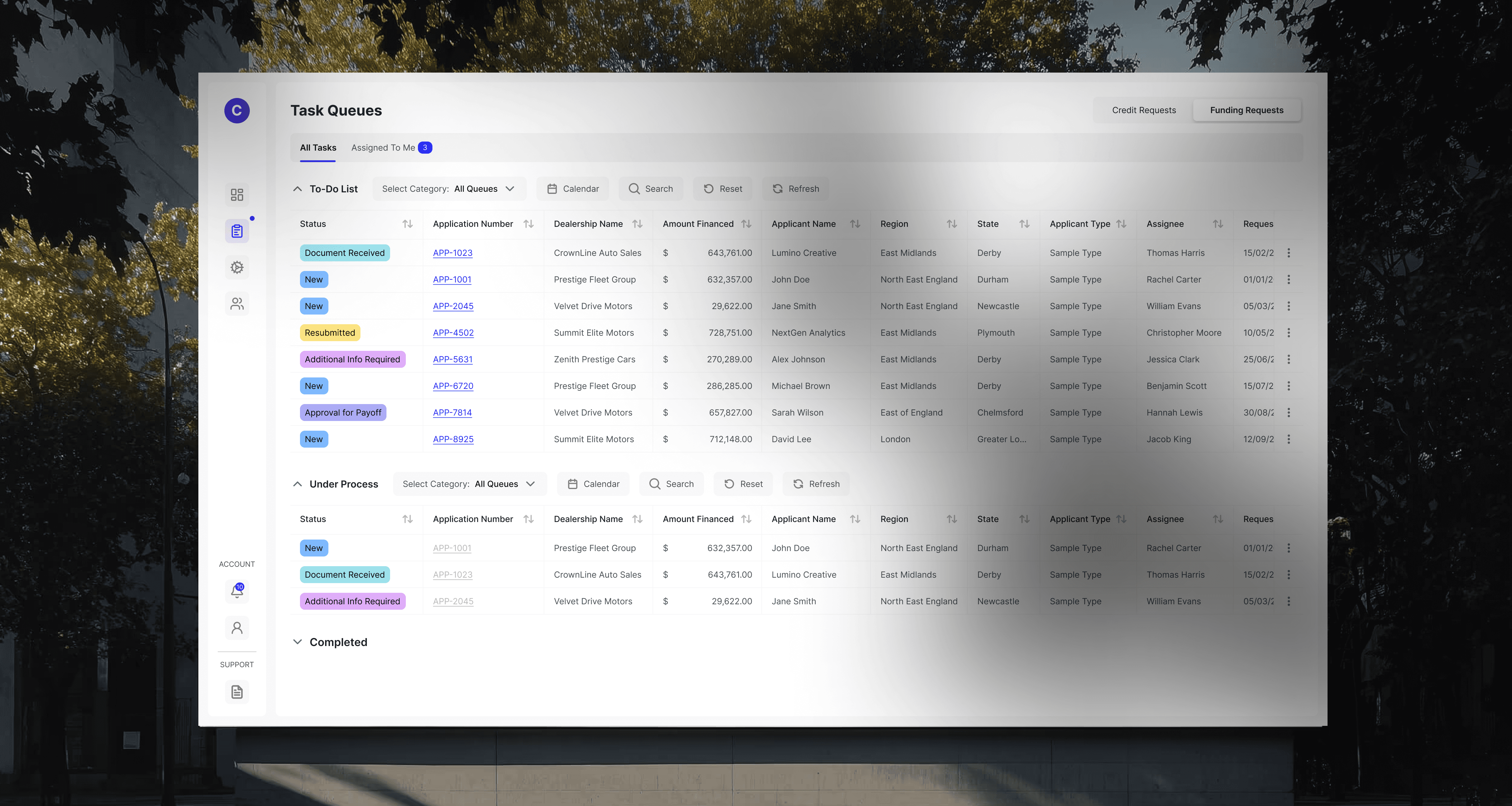

Task Management System

Build and adjust credit logic visually. From thresholds to triggers, every business rule is configurable through an intuitive interface giving analysts control.

Applicant Dashboard, Decision Made Smarter

The Credit Analyst screen empowers analysts to review applicant profiles, like financial insights, and risk indicators in one place. With tools like AI-powered recommendations, and structure comparison, analysts can approve, decline, or adjust deals confidently. The design focuses on clarity and speed, ensuring every decision is both accurate and compliant.

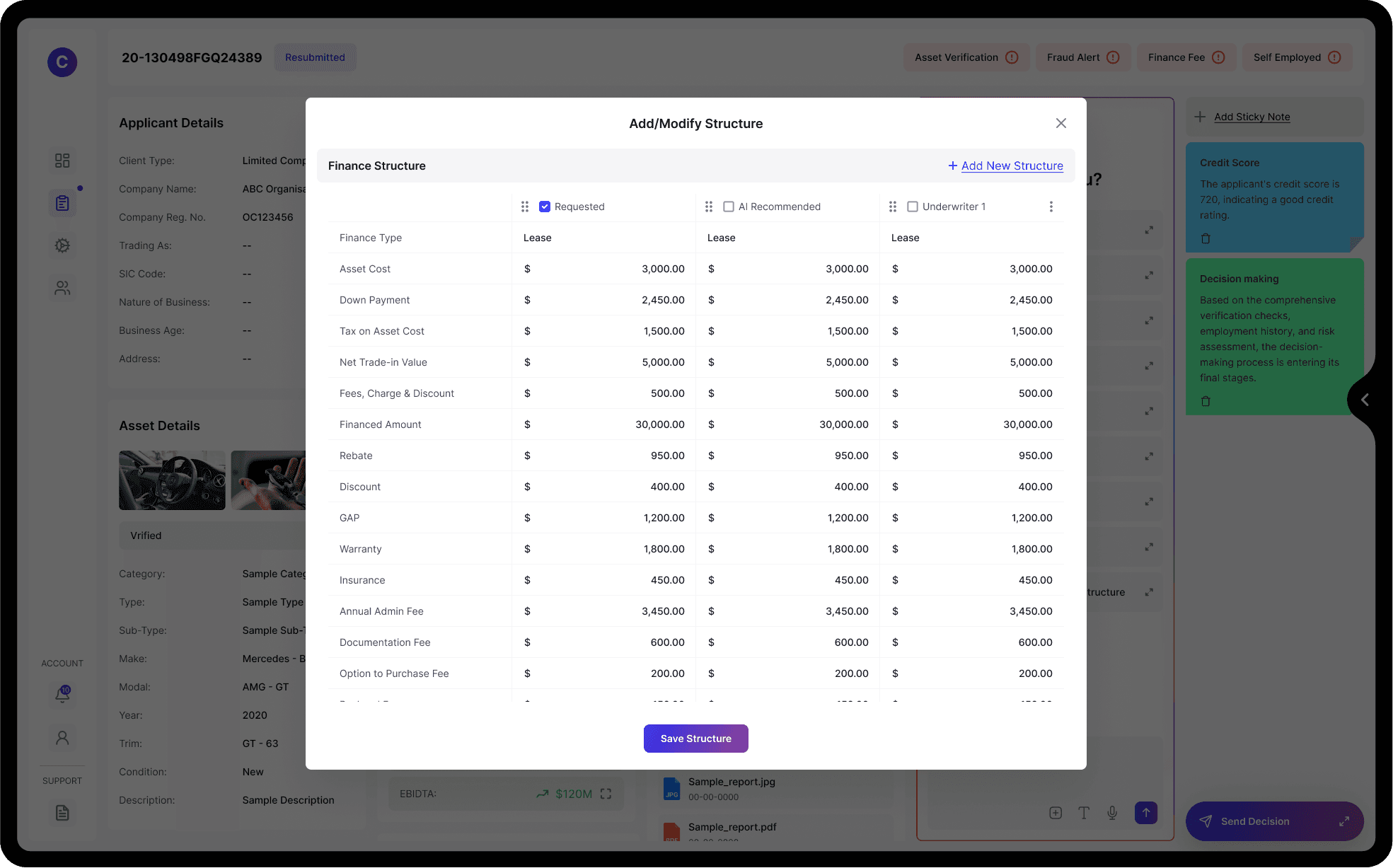

Finance Structure Comparison

Side-by-side comparisons of multiple financing structures,complete with AI-assisted suggestions. Empowering analysts to make the best deal, faster.

Notes & Audit Trail

Trace every thought and decision with contextual notes and a fully transparent audit trail. Because compliance and clarity should never be optional.

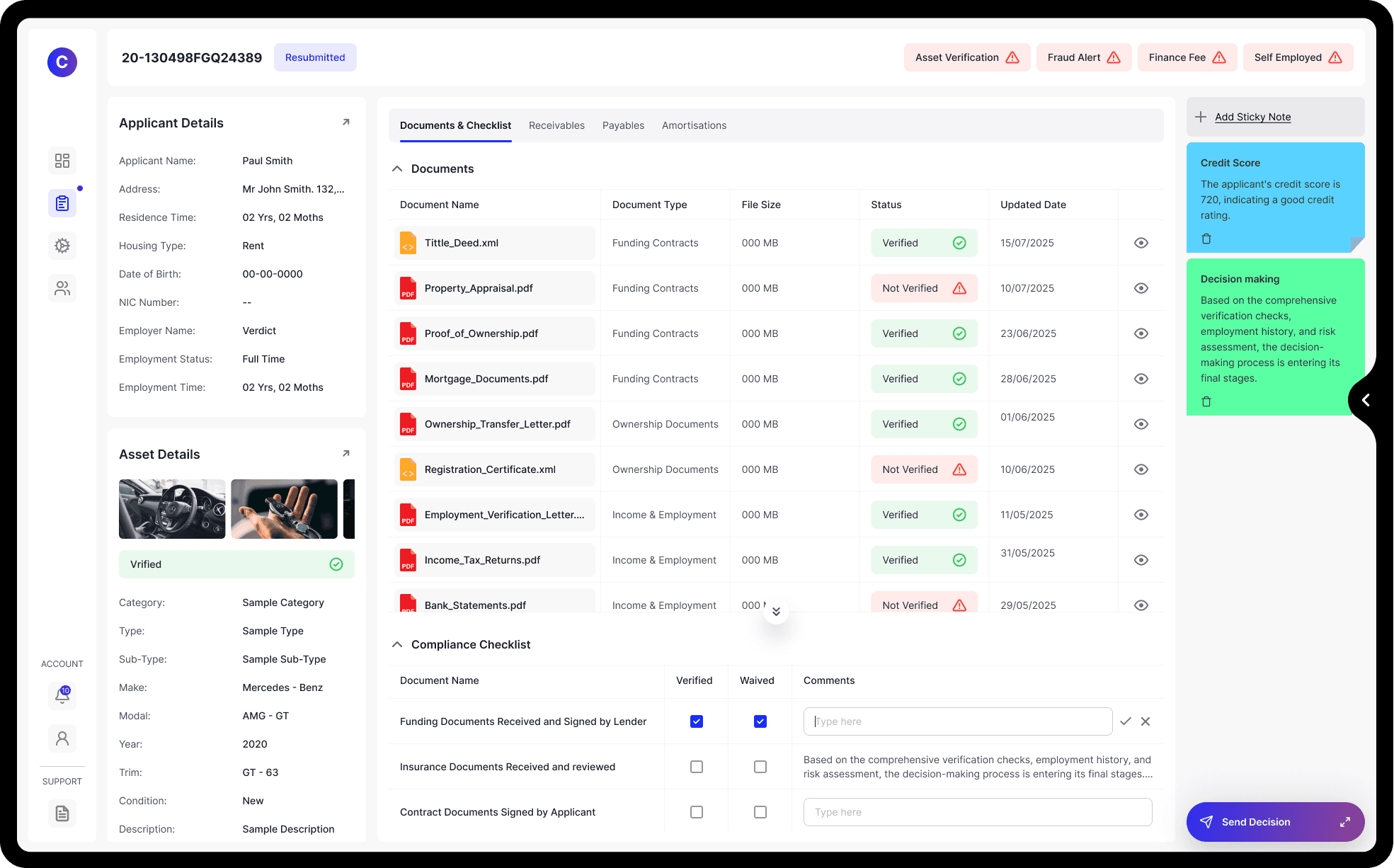

Applicant Dashboard, From Approval to Funding

Funding Analysts can validate documents, review compliance checks, and manage payouts. Designed for efficiency, the dashboard ensures every approved deal moves smoothly from decision to funded status, reducing delays and boosting accuracy.

Send Decision

The Send Decision window empowers analysts to send finalised loan deal with precision. Add stipulations, apply conditions, and send approvals or declines seamlessly. Every action is tracked in a comprehensive decision history, ensuring accountability, compliance, and full visibility for future reference.

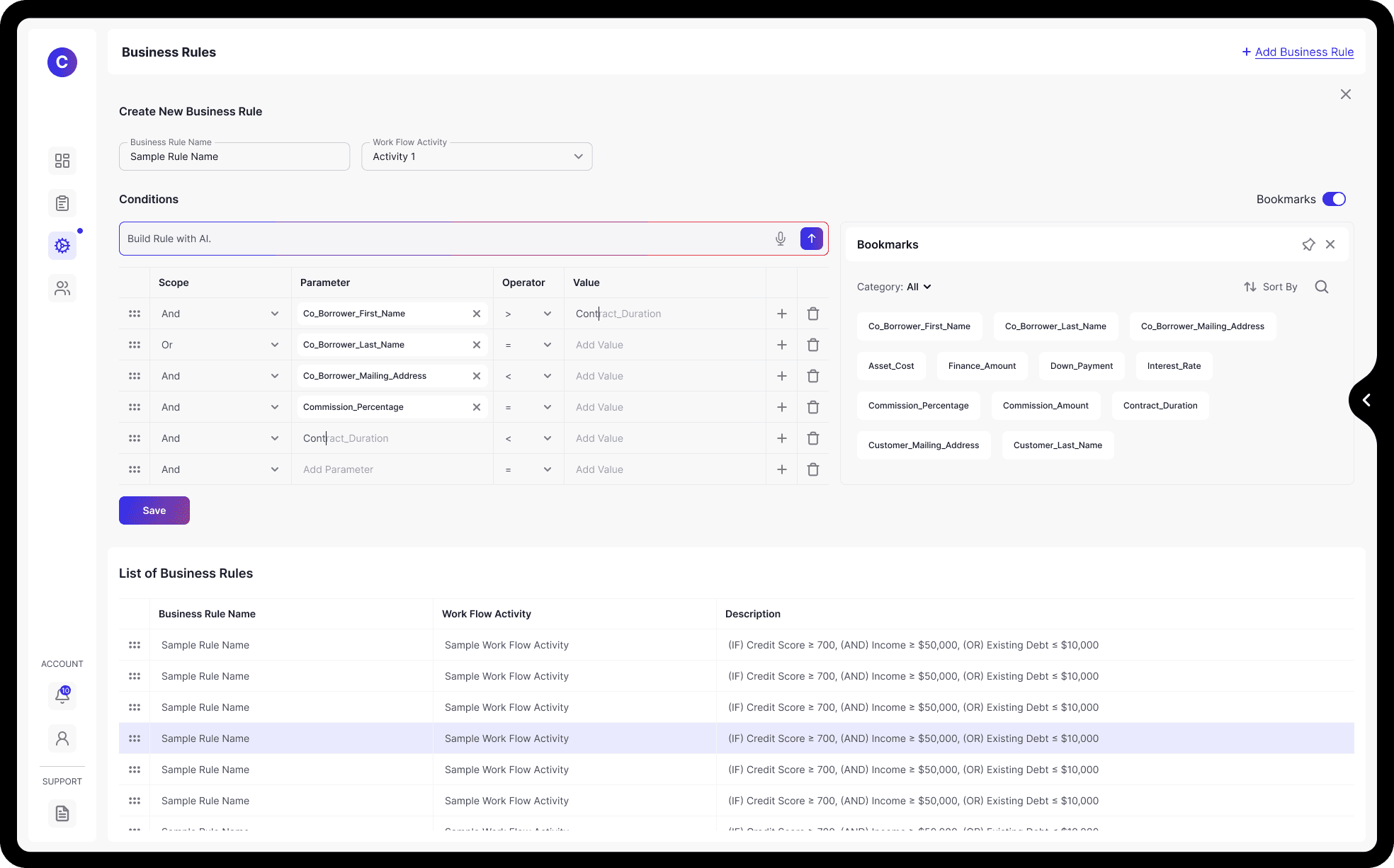

Business Rule Configuration

Build and adjust credit logic visually. From thresholds to triggers, every business rule is configurable through an intuitive interface giving analysts control, not code.

Score Card Configuration

Design and modify internal scorecards based on key metrics. Adjust weightings, review model performance, and simulate outcomes, all without breaking a line of code.

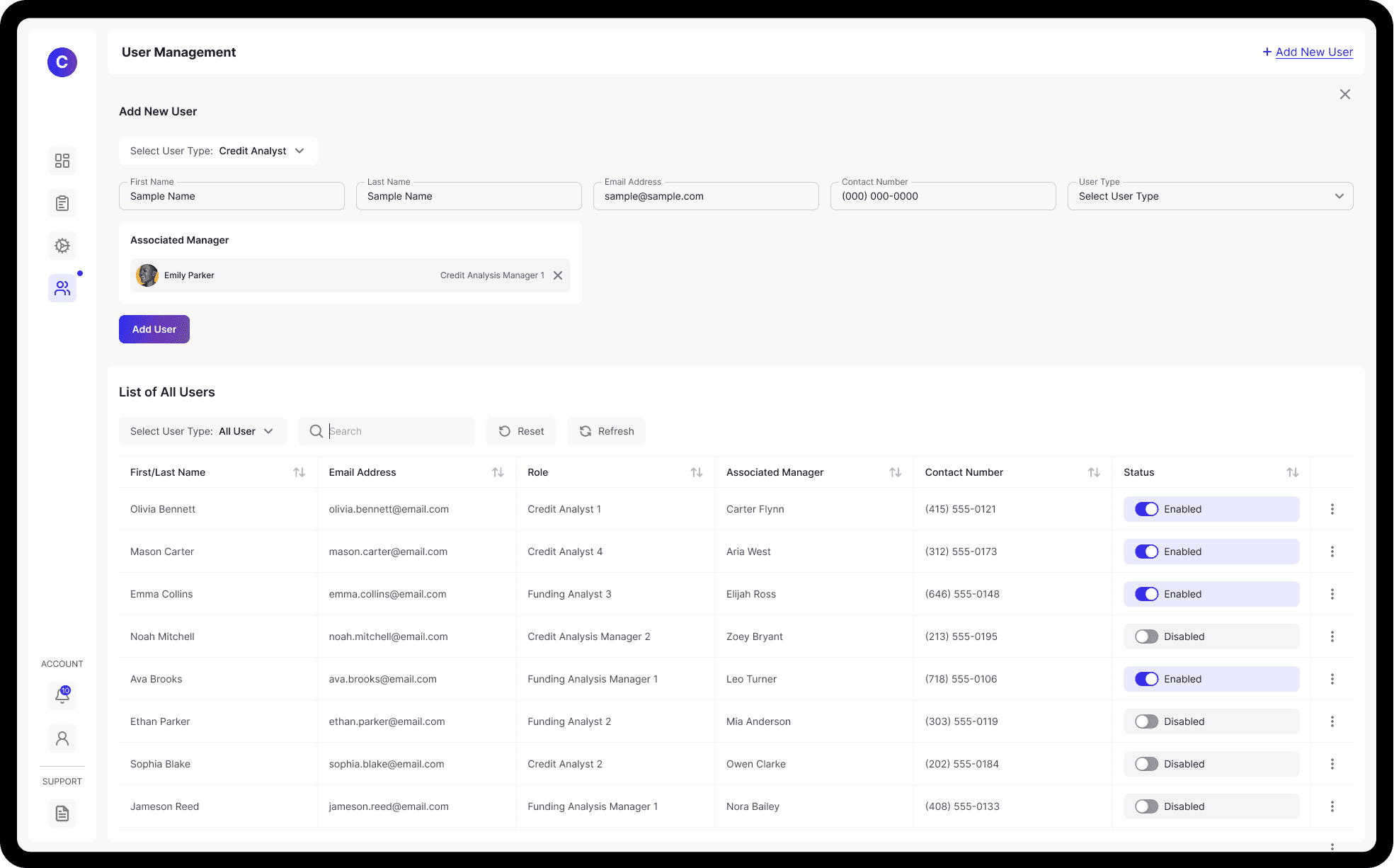

User Management System

Define roles, assign permissions, and control access whether for credit analysts, funding teams, or managers. A secure, scalable solution to manage your growing operation.

Final Results

The launch of Check AI brought real, measurable improvements to the decision-making process. By simplifying complex tasks and offering intelligent suggestions, it empowered analysts to work faster and with more confidence.

60% reduction in errors related to compliance and business rule violations

Time to decision dropped from 2 hours to under 5 minutes.

Analyst satisfaction improved by 42%.

Loan approval accuracy (based on repayment risk models) improved by 28%.

Overall, Check AI transformed the way analysts approach credit decisions—making the process smarter, smoother, and more reliable. This successful outcome proves how thoughtful design and the right technology can create real business value.